By Zainab.joaque@awokonewspaper.sl

Freetown, SIERRA LEONE – In its latest publication, the Sierra Leone Medium Term Debt Strategy 2023-2027, the Ministry of Finance underscores its reservations about the heightened rollover risk within the domestic debt portfolio.

According to the analysis presented by the Public Debt Management Division, the Average Time to Maturity (ATM) for the total debt portfolio was 8.5 years at the end of 2022, reflecting a deterioration from 9.3 years at the close of 2020.

The Division highlights a concerning trend, with the external and domestic debt ATMs standing at 10.6 years and 1.0 years, respectively, by the end of 2022. This compares to 11.4 and 1.7 years in 2020, indicating an increased rollover risk in both domestic and external debt portfolios.

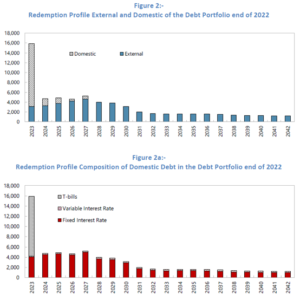

The high ATM for the external debt portfolio is attributed to the longer maturity profile typical of concessional debt. Conversely, the domestic debt portfolio poses a significant refinancing risk, as 75.0 percent of domestic debt is set to mature in less than a year, compared to only 5.5 percent for external debt.

Moreover, the report emphasizes that considering the maturity profile of up to 5 years for verified domestic suppliers’ arrears contributes to improving rollover risks in the domestic debt portfolio.

A detailed maturity profile chart illustrates the concentration of domestic debt in the first year (2023) and the distribution of external debt over 40 years, albeit with substantial maturities between 2023 and 2027.

Another identified risk is the escalating interest rate risk, attributed to the entire domestic debt portfolio consisting of fixed-interest rate instruments. The report reveals that 27.7 percent of the total portfolio is set to be re-fixed within 1 year by the end of 2022, compared to 19.8 per cent at the close of 2020, signalling a deterioration in the interest rate risk parameter.

Significantly, interest rate risk is particularly pronounced in the domestic debt portfolio, with 75.0 per cent of domestic debt slated for re-fixing within one year, compared to 14.2 percent for external debt.

In summary, the Sierra Leone Medium Term Debt Strategy 2023-2027 highlights a substantial exchange rate risk exposure in the overall debt portfolio, accompanied by emerging high-interest rate risks. The report advises prudent risk management, emphasizing the need to balance exchange rate risks from external debt against the low cost and rollover risk associated with external debt and foreign currency-denominated domestic debt. The report underscores the significance of minimizing the frequent rollover of domestic debt to mitigate higher interest rate risks. ZIJ/8/1/2024

Top of Form